It’s true: Australian Seniors are being left behind by out-of-pocket health insurance costs.

Senior Aussies are stuck paying for pregnancy, IVF and orthodontics cover.

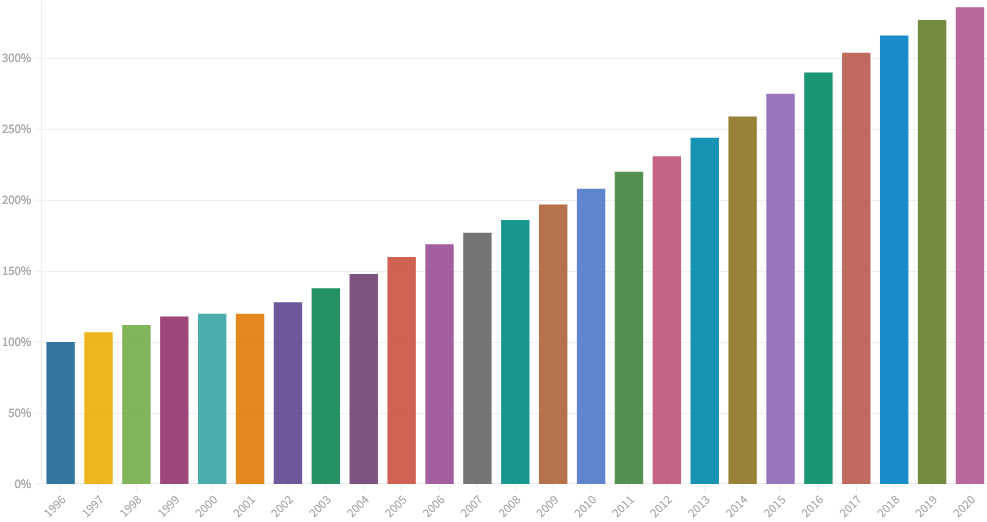

The National Seniors Association (NSA) have estimated that over the past decade health costs have increased by 56.7%, despite inflation increasing just by 23.5% over the same period*. The chart below, says it all. “Unless the underlying issues are addressed, Australian seniors could face skyrocketing health insurance premiums that will increase by a ridiculous 66% this decade”, NSA’s chief advocate Ian Henschke has stated.

Average Health Insurance Premiums Over Time

The average health insurance premium is nearly 3.5 times higher in 2020 than it was in 1996

At Count Every Penny, we know these increases could leave older Aussies struggling to make ends meet and that’s why we have teamed up with HealthInsuranceComparison.com.au to help senior Aussies compare their health insurance for free, with no obligation to sign up. We have made sure all policies that Aussie seniors compare have no lock-in contracts and that the cover types seniors choose are the ones seniors need.

HealthInsuranceComparison.com.au ’s CEO Andrew Davis says, “it’s not at all uncommon to speak to people in their 50’s, 60’s and beyond, who are still paying for cover like pregnancy, orthodontics and IVF”. We think this is outrageous and that’s why we’ve made it our mission to make sure you aren’t paying for inappropriate cover.

Here’s How You Do It:

Step 1: Select your current life stage below.

Step 2: Once you select your preferred coverage options, you will have the opportunity to compare quotes from multiple health funds.

Did you know that a recent survey of 6000 NSA members revealed that seniors want lower out-of-pocket fees for specialists, cost-effective private health cover premiums, and more funding from Medicare across more services, including public hospitals?

According to Ian Henschke, seniors who are often on “low and fixed incomes are particularly hard hit and are forced to put off medical treatment or cut their private health cover”, and we think this is horrific. We do not want seniors putting off medical treatment or cutting their private health insurance, because we know there are more affordable options out there.

We know it is possible to get health insurance cover from as little as $3.22 a day**. We also know, and it is one of the main reasons we have partnered with them, that HealthInsuranceComparison.com.au saves their customers an average of $357.95*** annually.

Insurance policies are confusing to compare and the insurers know seniors struggle to understand the lingo, which keeps them from switching to more affordable health cover. For example, did you know you do not need to re-serve waiting periods on hospital cover? Or that you could be getting less than the full rebate you are entitled to? This is why we are doing the hard yards for seniors.

We are 100% Australian owned and operated and so are HealthInsuranceComparison.com.au. The best part about our partnership is, there are no outsourced call centres, anyone you speak to is from Sydney, Brisbane or Melbourne and are experts in the health insurance industry.

Get Started Now:

Step 1: Select your state below.

Step 2: After answering a few questions, you will have the opportunity to compare quotes in your area and could be eligible for significant savings.

We have already had thousands of senior Australians jump on board and compare with the team at Count Every Penny and HealthInsuranceComparison.com.au. We could offer you significant savings, especially with the April rate rise looming.

To get help comparing your health insurance, click here. If you want to find out more about the NSA campaign that is working tirelessly to help Australian seniors pay less for health cover, see the link below^.

*Statistics taken from Australian Department of Government Health, average annual increases in private health insurance premiums, https://www.health.gov.au/resources/publications/average-annual-increases-in-private-health-insurance-premiums

*The daily and/or weekly figures are based on a Bupa Basic Accident Only Hospital with Freedom 60 Extras policy, which has a monthly cost of $96.01 in NSW for a single individual aged 70+ (assuming the maximum possible government rebate) as of 01/10/21. Prices may vary based on location, age, and circumstances.

**Average savings based off 13,136 customers during 2020

^NSA Campaign, https://nationalseniors.com.au/?_sp=c0fb85aa-9335-412b-9670-76952d93d82e.1609554161961